The Case for Buying Bitcoin

Bitcoin is moving towards financial ubiquity, much like the Internet did in the 2000s.

Introduction

One of the reasons Bitcoin is so intriguing is that there are an amazing number of angles to discuss it from: financial, technological, sovereignty, energy, psychological etc.. However, today, I want to focus on three key angles most important for any investor:

This article will be more technical than usual, featuring plenty of charts, so lets strap in and explore why I believe all investors should be buying bitcoin.

First angle: Financial

Let’s look at three specific aspects from the financial angle:

Supply and demand

Return on Investment (ROI)

Sharpe Ratio: risk-adjusted return

Supply and Demand

The price of Bitcoin, like any asset, is primarily driven by the dynamics between supply and demand.

Supply - transparent & predictable issuance of bitcoin

Unlike fiat currencies which are subject to irregular increase in supply, bitcoin has a fixed supply of 21 million coins. This finite supply is critical because as bitcoin adoption increases globally, the supply remains static, driving up the price as demand increases.

Bitcoin is engineered such that its supply goes through the well known “halving” cycle roughly every four years, reducing the rate at which new bitcoins are created and further tightening the supply. The chart below shows how bitcoin’s supply has been reducing since its release in 2009; as of 8th August 2024, 19.8 million bitcoin issued, or roughly 94% of the total supply.

Demand - adoption will only increase

Meanwhile, institutional adoption, retail investors, and even governments are starting to recognize bitcoin's potential, increasing demand steadily.

A famous term in the bitcoin space is HODL (Hold on for Dear Life), meaning not selling bitcoins no matter what circumstances.

The HODL phenomenon, while often times expressed casually or just as a joke, displays an undeniable trust among those who truly understands bitcoin to be the best, if not one of the best, store of value mechanisms.

Think of it this way: those who have understood bitcoin, will not simply sell their bitcoins. As more people gradually understand bitcoin, the cycle continues and the demand goes up.

You can visualize this through the long term holder supply chart. It shows the amount of bitcoin that has not been moved for longer than 155 days.

Source: Bitcoin Magazine Pro The blue section shows the amount of bitcoin held longer than 155 days, and as of 31st July 2024, the amount stands at 14.9 million bitcoin. That number has been trending upwards over the years.

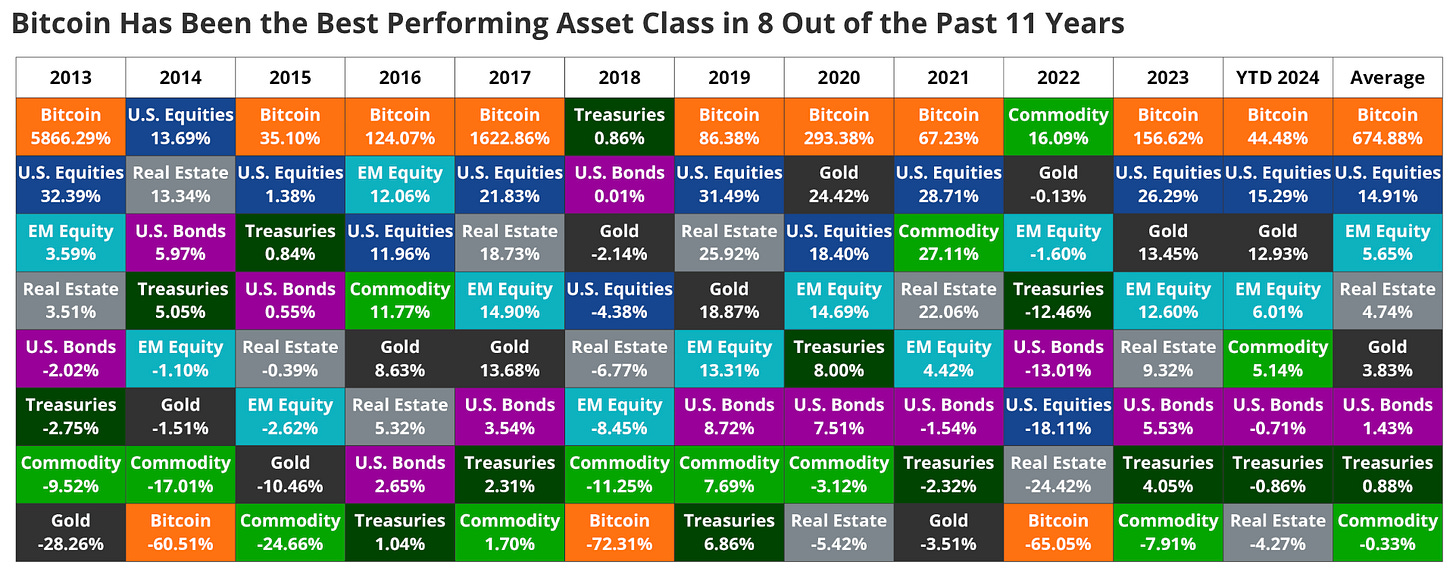

Return on Investment (ROI): The Best Performing Asset

In simple terms, ROI is like a report card for your investment. It shows you how much money you’ve earned (or lost) compared to what you put in. For example, if you invest $100 and after some time, your investment is worth $150, your ROI is 50%. This means you've made a 50% profit on your original investment.

Bitcoin has consistently outperformed traditional asset classes such as stocks, bonds, real estate, and gold. Over the past decade, Bitcoin has delivered unprecedented returns.

A reminder: the second chart above is not a price chart. It is the ROI over a 5 year period if you had bought bitcoin in August 2019 and held it.

An ROI of almost 500% today means that:

$100,000 worth of bitcoin in August 2019 becomes almost

$500,000 in August 2024

Even at its worst “crash” around December 2022, when the price went from a peak of $69k to $15k, its ROI of 45-50% would still be higher than the ROI of investing and holding S&P 500 or gold.

Side note: A common argument from critics is “if you bought at the peaks you would have lost money”.

This is only true if you bought it once during its previous peak of $69k (around November 2021), and sold it for a price that is less than that.

This is also why a popular strategy in buying bitcoin is dollar cost averaging (DCA), where you regularly invest a fixed amount of money into an asset regardless of its price to smoothen out the volatility.

We will go through the power of DCA in another article, but if you consistently invested since November 2019, your returns would still be well over 100% today. Check it out for yourself with this nice DCA visualization site.

Sharpe Ratio: Risk-Adjusted Returns

For investors concerned about risk, the Sharpe Ratio is a key metric. It measures the return of an asset relative to its risk, providing a clearer picture of the quality of the investment. Simply put, the higher the Sharpe Ratio, the better the risk-adjusted returns.

Despite Bitcoin’s notorious volatility, its Sharpe Ratio has often been superior to that of traditional assets, indicating that on a risk-adjusted basis, Bitcoin has delivered better returns.

Bitcoin offers more return per unit of risk, making it not just a high-return asset, but a smart one when viewed through the lens of modern portfolio theory.

Any smart investor should see by now that bitcoin offers one of the best mid to long term returns. Even if you do not understand bitcoin and what it stands for, the well-established financial performance should capture any investor’s attention.

I am advocate for bitcoin for reasons deeper than the financial returns, but that deserves another article on its own. Lets take a look at the next angle to consider the case for buying bitcoin.

Second Angle: Technology

Here, I discuss three key themes around the technology aspect of bitcoin, and why all these themes support the bullish case for bitcoin.

An early adoption of technology

A superior form of money enabled by technology

Revolutionary technology is typically shunned before being adopted

People have done great work to describe these aspects, so I synthesize what I believe are the most impactful themes for investors to consider.

Early Adoption of Technology: The Internet Analogy

Investing in Bitcoin today is akin to investing in the internet during its early days. Back in the 1990s, very few people understood the internet’s potential, and those who did and invested in companies like Amazon, Google, or Microsoft saw astronomical returns. Bitcoin, as the world’s first truly decentralized digital currency, represents a similar paradigm shift.

Just as the internet revolutionized how we communicate, shop, and access information, Bitcoin is revolutionizing how we think about money, value, and ownership. The best part is: the internet has enabled the instant flow of information globally, and you can access and buy bitcoin almost from anywhere in the world provided you have access to the internet.

Jurrien Timmer from Fidelity, one of the largest investment companies in the world, shared a great chart on X showcasing the historical adoption of new technology over centuries ranging from radios to motor vehicles to the internet, and the current trajectory of bitcoin (BTC), in black line below.

Key takeaways:

We are still early in the bitcoin adoption phase, with less than 1% of the per capita adoption rate as of June 2024

Technology is exponential: it takes years for adoption to increase slowly before suddenly reaching mass adoption.

Bitcoin: A Superior Form of Money Enabled by Technology

In my substack introduction, I presented my view about why bitcoin is so significant:

For the first time in history, we have a form of money that is based on improved technology and secured by neutral energy.

Without going into the technical details, lets explore the technology aspect of bitcoin that makes it stand out.

An account on X named “Stack Hodler” has done a fabulous job in presenting this, so I will quote the post because it is just that wonderfully presented. Check out the post below:

To paraphrase the key points of the post:

Bitcoin is a technological breakthrough designed to solve one of humanity’s oldest problems: how to store wealth long-term without the risk of debasement and seizure.

Why bitcoin is valuable:

It’s Finite: Only 21 million bitcoins will ever exist, and no one can debase your wealth by creating more bitcoins.

It’s Divisible: You can buy or sell $0.10 worth or $10 billion worth of bitcoin, making it accessible to all investors.

It Can’t Be Seized: Bitcoin can be stored in ways that ensure no external party can take it from you. You have full control over your property.

It’s Supply Inelastic: As the price of bitcoin rises, there’s no way to produce more of it, preventing sudden supply gluts.

It’s Portable: You can move anywhere in the world with your bitcoin, free from the restrictions of borders and regulations.

It’s Free From Counter-party Risk: Even if banks around you collapse or the existing financial system suffers a major breach, your bitcoin remains secure.

It’s Globally Accessible: Bitcoin isn’t tied to any jurisdiction, and it’s a fair, open protocol available to everyone.

A lot of the traits above address the properties of money and what properties should good money possess. As a reminder from my first post:

The current financial system we live in is less than 55 years old

Money has improved overtime due to the advancement in technology

People always adopt the better and superior form of money

Revolutionary technology is typically shunned before being adopted

Here is a clip from one of the most famous inventors and investors in modern age:

Would you believe that there were (prominent) people and media making fun of the following technologies?

The Telephone

The Internet

The Car

J.P. Morgan himself once made fun of cars. Lesson here: do the work, understand the fundamentals, make your own judgement.

Third angle: Macro view / Regulatory

I decided to combine them here because they are closely related. In short, this section dives into the institutional and corporate adoption of bitcoin, which is generally a positive sign for investors.

Bitcoin ETFs and Regulatory Clarity

The approval of spot bitcoin exchange-traded funds (ETF) in the United States on January 2024 marks a significant milestone for bitcoin. While spot bitcoin ETFs have been approved in other countries since 2021 — the first one being Canada called Purpose Bitcoin ETF — the U.S. approval is particularly impactful due to the size and influence of its financial markets.

To put the importance of ETFs into perspective: they represent the largest category of institutional bitcoin holders at roughly 5% of all bitcoins, worth a whopping $62.7 trillion.

The U.S. ETFs have accumulated more than 4% of all bitcoins supply today. Blackrock, the world’s largest asset manager, holds roughly 1.6% of bitcoins through this ETF, equivalent to $20 trillion dollars.

I have mixed feelings about ETFs; on one hand, they simplify bitcoin exposure for institutional investors. On the other hand, they commoditize bitcoin into another financial product, diluting some of the properties that make bitcoin unique, such as removing counter-party risk. Nevertheless, the influx of institutional money is likely to drive up Bitcoin’s price in fiat terms.

Corporate Adoption: Public Companies Buying Bitcoin

In addition to ETFs, more non-crypto and traditional public companies are starting to add Bitcoin to their balance sheets. Companies around the globe like MicroStrategy (U.S.), Metaplanet (Japan) have already invested billions, seeing Bitcoin not just as a speculative asset, but as a long-term store of value. This trend is likely to continue as more corporations look for ways to hedge against currency debasement and diversify their holdings.

The entry of such large players into bitcoin is not just a vote of confidence but also a signal that bitcoin is maturing as a financial asset. I foresee more companies and countries adopting this strategy, pushing bitcoin further into a mainstream financial asset.

Closing Thoughts

I approached this article with the question to myself: if I had one hour to convince an investor on why he or she should buy bitcoin, what would I say?

I believe these three topics: financial, technological, and macro/regulatory, are the most crucial and relevant topics today.

Bitcoin is rapidly evolving, but its fundamentals remain unchanged. If you're an individual investor, consider learning about Bitcoin (I firmly believe in only buying what you understand). For institutions, significant groundwork has been laid to pave the way for Bitcoin, making it clear that Bitcoin warrants serious consideration and strategic planning for investment.

Disclaimer: The information provided in this publication is for informational purposes only and does not constitute financial advice. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions.