In my previous article, I argued that due to evolving technology, it is not unreasonable to expect money to improve, especially given that the current financial system we live in is only less than 55 years old.

Bitcoin, as a new form of money, is the culmination of decades of advancement in cryptography and buids upon the original 1998 e-cash concept by Dai. But most people I know do not care about what Bitcoin is. Hence, I decided to present the “why” from a practical perspective.

Long story short, Bitcoin was created to protect you and I as consumers from the inherent flaws of the current monetary system. Bitcoin does that by removing the need to trust third parties in facilitating transactions. Simply put, third parties often hold too much power and are capable of breaching consumer trust (which have been done many times).

Lets dive into the “why” of Bitcoin, simplified into three parts:

The nature of commerce

Hidden costs of a third party in a trust-based monetary system

Bitcoin as a secure, peer-to-peer money solution

Part One: The nature of commerce

Commerce refers to the activity of buying or selling goods or services. At its core, any commercial activity requires only two parties:

The Buyer

The Seller

Historically, when our ancestors had extra spears for hunting but insufficient fur coats, they would trade spears for fur coats with another tribe or group. This is a primitive form of commerce. As societies evolved, humans began using physical money, such as seashells or metal coins, to pay for goods or services. This simple “buyer and seller” model worked fine for in-person transactions.

However, with the advent of technology and the growth of the economy, transactions have become more complex. To reduce these frictions in commercial activities, humans gradually shifted towards having central entities to facilitate transactions. Consequently, our monetary system evolved into a predominantly trust-based system, where financial institutions keep track of transactions to reduce these frictions.

Today, most transactions involve more than just the buyer and seller. They often include:

The Buyer

The Seller

Third Party (or Parties)

Being in a relationship with two people only is already tough. Imagine adding a third person to the mix. Lets discuss a critical aspect of relying on third parties in the next part.

Part Two: Hidden costs of a third party in a trust-based monetary system

For simplicity, let's assume that banks are the only third parties involved in the current monetary system.

We are used to having banks (third parties) facilitate transactions on a daily basis. After all, its the system that most of us are accustomed to. Yet, the reliance on third parties introduces several hidden costs including delays and censorship. The largest risk, however, remains the reliability of these third parties in meeting their obligations.

In a trust-based system, users must place their trust in these intermediaries to act in their best interests. You must trust your bank to hold your money, perform the transactions that you want on demand, and trust that the money is actually a store of your wealth. However, history has shown over and over again that these central entities have regularly betrayed that trust. Recent examples:

During the 2008 financial crisis, a network of banks and financial institutions colluded to inflate the prices of mortgage-backed securities, leading to a massive housing market bubble. When the bubble burst, it resulted in a global economic meltdown, with millions losing their homes and savings.

The recent COVID-19 pandemic led to various questionable fiscal policies, such as the large money supply increase that led to sustained and high inflation; the impact of which is still felt as of July 2024.

Part Three: Bitcoin as a secure, peer-to-peer money solution

Bitcoin was created to address the weaknesses of a trust-based system. By removing the need for intermediaries, Bitcoin allows individuals and entities to transact directly with one another, eliminating the need to rely on a third party. More importantly, Bitcoin creates an option for people to utilize an entirely separate financial system, one that is transparent, cleverly engineered, and decentralized (free from central manipulation).

In the original Bitcoin whitepaper, the scope of the problem was narrowed down to “commerce on the internet” and “electronic payments”, which required financial institutions (third parties) to mediate any disputes or frauds. In reality, the real problem is that the global financial system is dependent on the central banks. Here is the quote from the creator of Bitcoin on the issue with the current system:

“The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve”

There is a lot to unpack in the quote above. To simplify:

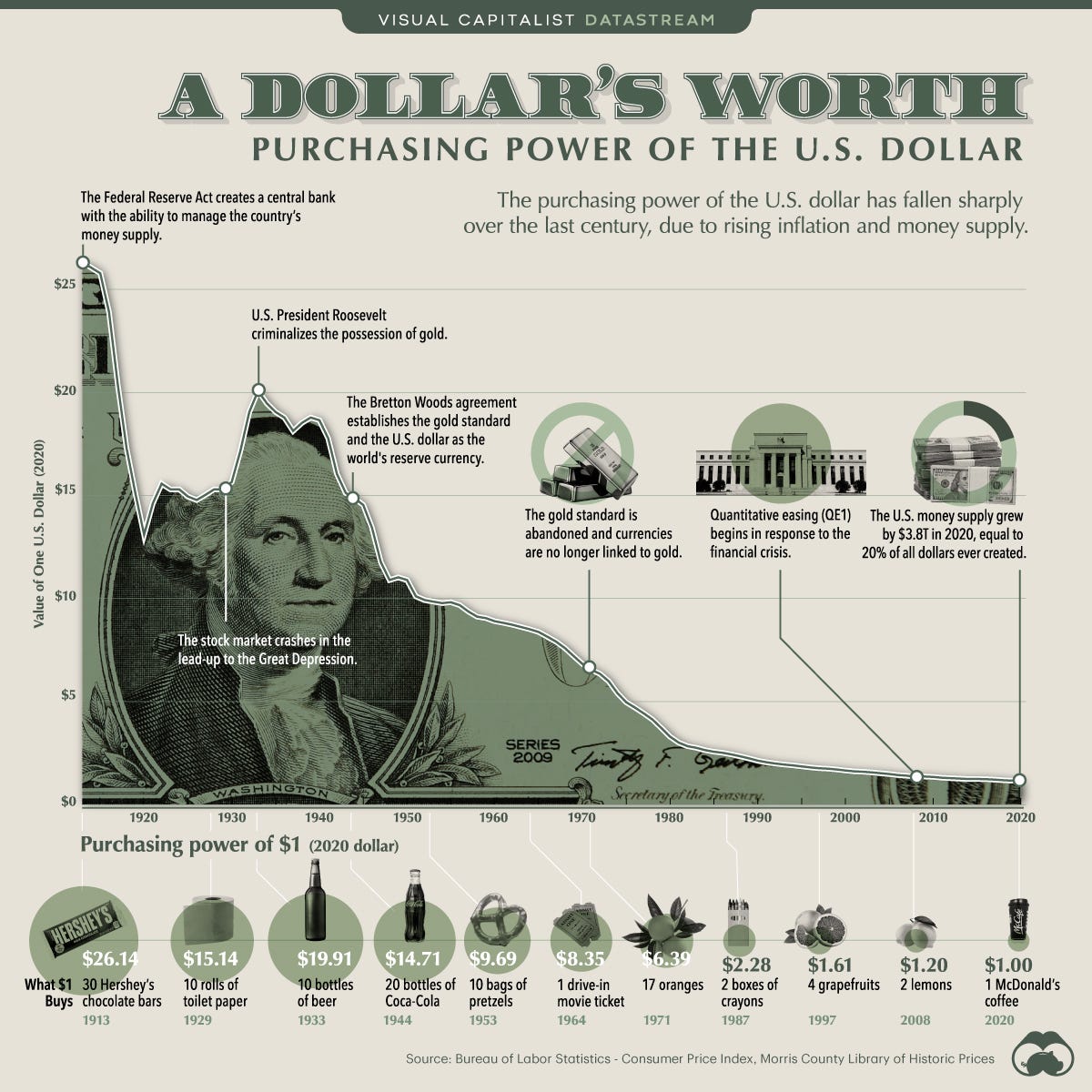

debasing the currency: this means to reduce the real value of the currency you hold, typically by increasing the money supply. As a result of debasement, 1 USD today is worth far less than 1 USD years or decades ago. See image below for a depiction of what 1 USD in 2020 is worth across the history of the United States.

barely a fraction in reserve: this refers to the fractional banking system. Basically banks hold only a fraction of your money in the bank. This is why bank failures or bank runs happen; if everyone decided to withdraw their money within a short time frame, banks will not have enough cash to actually give you the money.

However, the keyword here is again, trust. In the system today, we have little to no choice but to trust the banks to hold our money and the central banks to dictate the trajectory of a country’s fiscal path.

Closing thoughts

In the end, individuals should be able to make their own choice on whether they trust the money they use, or whether they trust the entity that manages and stores their money. This matters because money literally determines your fate and the quality of your life.

By leaving decision making to central authorities, the power shifts from the many to few, and history has shown that concentration of power rarely leads to a good outcome.

"Power tends to corrupt, and absolute power corrupts absolutely."

Lord Acton - 1887

Fortunately, with the advancement of technology and preservation of knowledge, humans are capable of designing better systems. Bitcoin is a better system created to tackle many of the issues we face today, and it is slowly but surely gaining momentum.

Disclaimer: The information provided in this publication is for informational purposes only and does not constitute financial advice. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions.