Why is Bitcoin so hard to "understand"?

Not the technical details of bitcoin, but why it is a solution to a fairer and more transparent monetary system.

When the internet was invented, most people could not imagine how it would reshape the world.

Even then, it took decades of continuous improvement and iterations from the 1950s before the invention of the World Wide Web in 1989 (the famous “www”), which we still use to access information on the internet today.

In the early days of the internet, many critics claimed it was doomed to fail. Yet, the internet remains stronger and more widely adopted than ever.

Today, Bitcoin is in a similar phase. Fifteen years after its public launch, Bitcoin continues to gain adoption despite price fluctuations and negative media portrayals. In 2024, Bitcoin's market capitalization surpassed $1 trillion ($1,000,000,000,000—yes, that's a lot of zeros).

At some point, it makes sense to ask: if it is truly useless and fake, why are more people, businesses and even countries adopting it after 15 years?

It might also make sense to ask: What are these people seeing that I am not?

The following quote gives you a hint of what is happening.

“Either everyone is collectively hallucinating, or an objective truth exists that allows each to come to the same answer. One or the other.”

— Parker Lewis, "Gradually, Then Suddenly"

Everyone who grasps what Bitcoin offers the world has spent hundreds, if not thousands, of hours studying Bitcoin itself, money, history, and economics before coming to the objective truth that Bitcoin is the best solution we have today for a sound money system.

The good news is, while it can get highly technical, you do not need to be a software engineer or computer scientist to understand what Bitcoin does. You only need to know the history of money, what makes a money “sound”, and what properties Bitcoin has that make it the best sound money we have today.

Even so, Bitcoin’s value is challenging to understand, and after extensive reading and conversations, I believe there are four main reasons why this is the case:

Mental energy to understand what makes “good” money and why our current system is failing

Willingness to accept that all systems are man-made, which can and eventually will be replaced

Money is a very personal and emotional matter

Distractions from the “crypto” space.

Let's dive into each reason in digestible chunks, as usual.

1) Mental energy to understand what makes “good” money and why our current system is failing

Understanding What Makes Good Money

Have you ever paused to think about “What is Money?”

Most people I met never thought about it.

We were born in one country, and each country uses its national currency (or some other legal tender). Those money (called fiat currencies today) is what is commonly accepted as money.

But money is merely a tool to facilitate economic transactions. It is the common “thing” used buy goods and services.

Money has continuously evolved throughout history, with societies using various forms of money—gold, tobacco, seashells, and more.

Here is a quick snapshot of how money has broadly evolved over history.

So, why don’t we use seashells or gold as our primary form of money anymore?

Because we invented better money that is more useful and reliable.

And there are ways to analyze what makes good money.

Without going into too much details here (as it deserves its own article), good money should satisfy the following properties:

Divisibility: Can the money be divided into smaller units?

Portability: Can it be easily transported?

Durability: Can it withstand wear and tear?

Fungibility: Is one unit of that money exactly the same as another?

Verifiability: Can it be easily identified as genuine?

Scarcity: Is it limited in supply?

Societies have replaced older forms of money when one or more of the properties above were unsatisfactory. Here are examples of money that have largely been replaced, some of which I borrowed from the book Broken Money.

Gold, for example, struggles with portability and divisibility. It is hard to carry heavy, large amounts of gold everywhere to make big payments. It is also difficult or cumbersome to divide accurately on the spot: how would you quickly and easily cut out 1g or 0.1g of gold, if needed?

Seashells failed due to scarcity and fungibility issues. Seashells were crafted by hand before being accepted as money. Then, people invented better ways of crafting seashells by machines that increased its supply tremendously. Also, one shell is not necessarily the same as the other (due to quality of craftsmenship), leading to varying degrees of value.

Similarly, tobacco failed because of scarcity and fungibility issues. When tobacco was used as money, more people started to grow tobacco, increasing its supply beyond control. Furthermore, the quality of tobacco is different depending on the species, skills of the farmer, etc., hence it is hard to standardize the value of tobacco.

Bitcoin’s design addresses all these historical weaknesses, making it a strong candidate for "good" money, but understanding that requires mental energy and a willingness to examine our current money system.

Understanding Why Our Current Financial System is Failing

To grasp why bitcoin is an essential alternative, you need to understand the flaws in our existing financial system.

The current system, with fiat currencies at its core, is primarily a debt-based system. When debt is used meaningfully, it drives productivity and growth.

For example, taking a loan to start a business that succeeds and adds value to society is considered good debt.

However, financial instituions have caused the system has become overleveraged (too much debt). The system is also often manipulated, leading to problems like massive inflation. This slow but constant erosion of your hard-earned savings makes it difficult for people to see the true cost of staying in the current system.

In the 2008 financial crisis, the U.S. financial system was leveraged at an alarming ratio of 150 to 1 in terms of the ratio of total debt in the U.S. credit system to dollars available to banks. In simple terms, this means for every 1 real dollar in your bank, there is 150 dollars of debt, or “fake money” in the system.

When people realized that the value of houses were just artificially increased, and there were much less demand in the market, the market eventually collapsed, leading to a global recession.

A similar issue happened in 2020 during the COVID pandemic. However, this time the problem is worse.

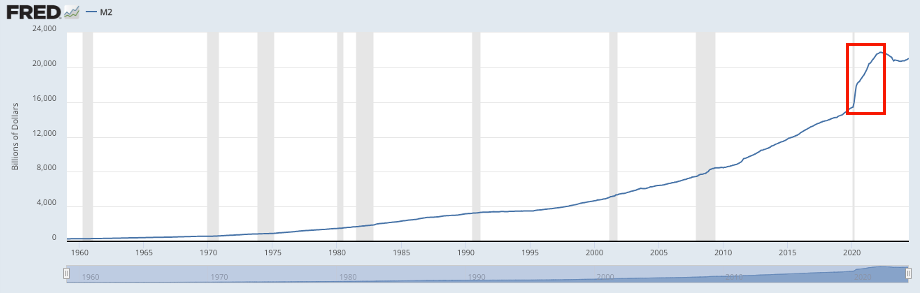

This chart shows the M2 money supply in the U.S. over time. M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money (such as savings deposits, money market securities, and mutual funds). Essentially, money that is liquid and relatively easy to use have increased.

Instead of using the country’s reserves assets (i.e. savings) to help people through the tough times (like what Singapore did), the US printed money massively. In fact, US printed $3.3 trillion ($3,300,000,000,000) in 2020 alone to fund all the initiatives. All in all, the M2 money supply went from roughly $15.4 trillion to $21.7 trillion at its peak, around a $6.3 trillion dollar increase.

Its hard to believe the world’s most advanced economy did not have savings to use for emergencies like this.

All the additional money has resulted in massive inflation not just in the US but across the world due to how closely linked the global economy is today, especially on the supply chain side.

For once, instead of trusting official inflation data (which I believe is largely misleading due to what and how its measured), ask yourself how have food and energy prices changed over the past few years for you?

Speaking from personal experience, food prices in Malaysia alone easily increased by 30-40% over the past 3 years or so, roughly 9-10% per year.

When the debt-based fiat system does not work

At its core, almost every country uses the central banking model which works by issuing local fiat currencies. When the government is competent and increases the productivity and economic value of the country and its citizens, you get countries with strong markets like the United States or Singapore.

However, when the system fails, usually through massive money printing (remember scarcity?), the value of the currency decreases tremendously.

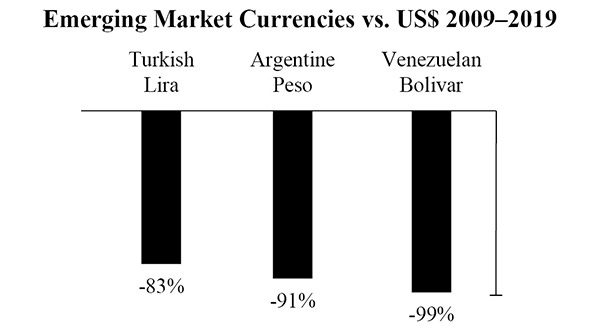

Take, for example, countries like Turkey, Argentina, and Venezuala, where hyperinflation has wiped out the value of their currencies.

There are many more currencies that went through the same fate: Lebanon, Zimbabwe, for example. They highlight the fragility of fiat money systems when things spiral out of control, often beyond the control of your everyday person who mostly just wants to live life well and peacefully.

Success and wealth may not last forever. Argentina was one of the wealthiest countries in the 20th century before massive money printing greatly devalued their currency and the savings of their citizens? The once great Roman empire also fell largely because they artificially inflated its money supply by reducing the amount of silver in one silver coin.

2) Willingness to Accept That All Systems Are Man-Made, Which Can and Eventually Will be Replaced

Everything Around Us is Man-Made

One of the most challenging ideas for people to grasp is that all systems we use and take for granted today is man-made.

Whether it’s the legal system, computer systems, or even societal norms, they were all created by people.

Even the current financial system. The Federal Reserve Act was signed in 1913, which led to the creation of the federal reserve that we know today and forms the backbone of the current banking system.

And all systems will eventually be changed and updated.

Steve Jobs famously said the following:

“Everything around you that you call life was made up by people that were no smarter than you, and you can change it, you can influence it, you can build your own things that other people can use.”

The Idea That Centralization is Needed For A System To Work

Furthermore, most people find it difficult to accept that a system not created by a government or central authority can function effectively.

However, some of the most valuable things available today are not owned by any one central entity.

Sticking to the Internet example: no one person, company or government owns the Internet. Yet it is the most powerful driving force of the world today.

Many open-source projects like Linux, Wikipedia, are maintained by groups of people voluntarily, but are highly successful projects that are widely adopted.

You’ve likely experienced many small systemic changes without even realizing it. For example, in certain developing countries, cash used to be the only way of making salary payments. In the 1960s, my grandparents would literally receive cash from their employers and store the cash in tin boxes. There were few established banks, no e-cash, no direct transfer of money digitally through the internet. There were no personal phones, no personal computers, not even personal calculators.

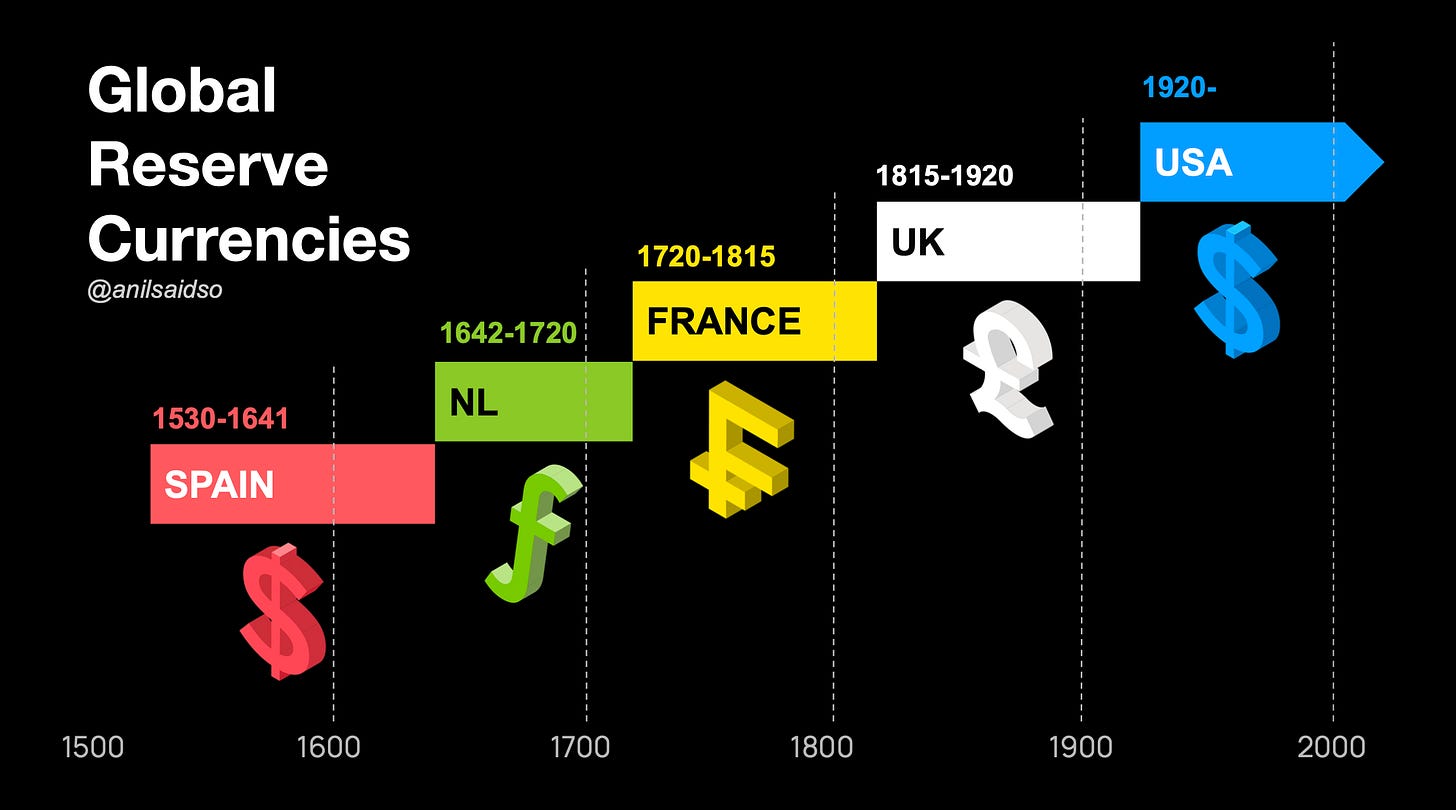

A major systemic shift would be when global reserve currencies changes. Today, the US currency is the global reserve currency, but there is no guarantee this won’t change in the next few years or decades.

Money itself is a system humans invented to facilitate trade and transactions, and as mentioned above, this system continuously changes.

The fact is: the systems we live in at the moment are merely the best that our ancestors could come up with decades or even centuries ago, and these systems are subject to change all the time.

Accepting this fact takes a significant mental shift.

3) Money Is a Very Personal and Emotional Matter

Money is highly emotional, and when emotions are involved, so are ego, stubbornness, and fear— all of which are barriers to logical and rational thinking.

I've seen many smart people dismiss Bitcoin without making an effort to study or understand it. The reasons vary, including ego and a know-it-all mindset.

For some, it’s the difficulty of changing their initial (usually negative) perception of Bitcoin, no matter how much success Bitcoin has seen. This is known as first-conclusion bias.

"The mind works a bit like a sperm and egg: The first idea gets in and then the mind shuts. But our tendency to settle on first conclusions leads us to accept many erroneous results and to stop asking questions."

— Charlie Munger

Ironically, the person who gave this quote likely suffered from the bias himself, but thats another matter entirely.

Existential Threat

I believe one of the major emotional reasons for resisting Bitcoin is that it poses an existential threat to some people.

Bitcoin challenges many conventional assumptions that were widely taught. If people believe their past or future success relies on these assumptions staying true, their willingness to accept it will be much lower.

It's difficult to get rid of mindsets and assumptions rooted in a financial system that's been in place since the 1960s.

This emotional attachment to money makes it hard for people to accept that the system they've trusted their whole lives might be flawed.

Furthermore, our relationship with money is often shaped by our past experiences and emotions. As mentioned in the book The Psychology of Money,

“But every financial decision a person makes, makes sense to them in that moment and checks the boxes they need to check. They tell themselves a story about what they’re doing and why they’re doing it, and that story has been shaped by their own unique experiences.”

― Morgan Housel, “The Psychology of Money: Timeless lessons on wealth, greed, and happiness”

This connection and experience makes it much harder for people to update their framework of what works best for them.

A Different Journey for Everyone

People need time to study money, study bitcoin, study their own circumstances, and determine for themselves when they need bitcoin. Notice I said when, with a conviction that there is a very high probability that adoption continues to increase and more people will eventually want to get their hands on bitcoin.

Everyone's journey is unique. Some people take years before their curiosity drives them to sit down and truly understand it. For me, it took seven years from when I first heard about Bitcoin—going from ignoring it, to being skeptical, to finally taking the time to understand it.

If you're content with a system that constantly devalues your savings, you may not feel the need for bitcoin. But for those who seek financial security and sovereignty, bitcoin becomes a necessity.

4) Distractions from the “Crypto” Space

Another reason Bitcoin is hard to understand is the noise coming from the broader "crypto" space.The sheer number of cryptocurrencies, scams, and hype projects makes it difficult for people to focus on bitcoin.

When people hear about hacks, scams, and lost funds, they often lump all cryptocurrencies together. However, it’s essential to distinguish the nature of these failures.

Scams from Compromised Wallets

Many of these scams involve people's wallets getting hacked. This doesn’t mean the Bitcoin protocol itself was compromised, like suddenly having more than 21 million bitcoins.

Equating this to "Bitcoin is unreliable" is like blaming a bank’s security system for a customer’s compromised account after they fell for a phishing scam.

Failure of Centralized Entities such as Exchanges

A key value proposition of Bitcoin is that you can keep your funds securely, eliminating what's known as counterparty risk.

If everyone keeps their own Bitcoin, it becomes very difficult and expensive for hackers to succeed because the money is so widely spread. Additionally, it’s technically very challenging to hack even one wallet if it’s set up correctly.

The problem arises when people store their money in centralized places like exchanges, which have failed multiple times.

One of the earliest and most infamous examples is the collapse of Mt. Gox in 2014. Once the largest Bitcoin exchange, Mt. Gox filed for bankruptcy after losing up to 950,000 bitcoin, worth hundreds of millions of dollars at the time, due to a combination of hacks and internal mismanagement.

More recently, the FTX scandal in 2022 further exposed the dangers of centralization. FTX, once a leading cryptocurrency exchange, collapsed after it was revealed that its leadership had misused billions of dollars in customer funds, leading to massive losses for its users and sent shockwaves through the entire industry.

The failure of exchanges above is similar to conventional bank failures, like the recent Silicon Valley bank failure in 2023 and all the other 547 US banks that failed from 2001 to 2024, where you rely on the banks to safeguard your money.

Scams from Non-Bitcoin Projects

Not all cryptocurrencies are equal. While the concept of cryptocurrencies is similar, the underlying technology differs vastly.

Consider countries as an analogy. The concept of a country is consistent: a defined border, a population, and a governing body. But not all countries share the same “standard”. Different governments, systems, and populations result in varying qualities of countries.

The same applies to companies—just because two companies operate in the same industry doesn't mean they’re equally reliable or successful. NVIDIA and AMD are both chip manufacturers, but they have different strengths and weaknesses, and hence different stock prices, different revenues, etc.

By that logic, not all cryptocurrencies are created equal. Bitcoin stands apart from the rest due to its decentralization, security, and fixed supply.

All the projects that failed were non-bitcoin projects that were not solving the problems that Bitcoin was trying to solve. Many of them were even designed to be pump-and-dump schemes. These projects are mostly centralized (controlled by a few people) rather than being truly decentralized like bitcoin, which is a key reason to its security and success as a form of money.

The chart below shows how bitcoin has performed relative to more than 2000 other cryptocurrencies up till end of 2019.

While the chart has not been updated to 2024, it shows that over the long run, bitcoin is the dominant because bitcoin’s properties make it a good form of money, and as people understand and see that it has long term value, they start to accrue more bitcoin, driving demand up. Furthermore, it shows that many people attempted to recreate bitcoin or redesign bitcoin, but none of them gained enough traction and adoption to be as secure, decentralized, and valuable as bitcoin.

The popular phrase is: Bitcoin, not crypto.

Final Thoughts

Bitcoin challenges the very foundations of the financial systems we've relied on for decades. It asks us to rethink our relationship with money, our trust in centralized institutions, and our assumptions about value and security. This is not an easy task, and it's understandable that many people find it difficult to grasp.

However, just as the internet overcame skepticism to become an integral part of our lives, Bitcoin too is poised to reshape the world. It represents a new form of money—one that is decentralized, scarce, and resilient, and its understandable why its hard to fathom, for some reasons stated above and below:

We never had a liquid asset that is absolutely scarce.

We never had a man-made currency that didn't have an central issuer.

We never had money where one person or one central body can manipulate how it works

We never had money where everyone has the power to verify all transactions, giving full transparency.

In a world where traditional financial systems are increasingly showing their cracks, Bitcoin offers an alternative—a way to preserve value, safeguard against inflation, and participate in a global, permissionless network. The future of money is already digital, and Bitcoin stands at the forefront of this evolution.

The question is not if Bitcoin will be adopted, but when. As more people, businesses, and even countries begin to see the value in this revolutionary system. In that case, it might make sense for you to get some or spend more time to understand it.

Disclaimer: The information provided in this publication is for informational purposes only and does not constitute financial advice. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions.